Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years. Bell had been a retailer of audio systems After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory.

Raw materials cost for an audio system will total $74 per unit. Workers on the production lines are on average paid $12 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $4,900 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000.

Instructions

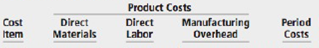

(a) Prepare an answer sheet with the following column headings.

Assuming that Bell manufactures, on average, 1,500 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns.

(b) Compute the cost to produce one audio system.

(a) DM $111,000

DL $ 90,000

M0 $ 18,100

PC $ 9,500

Classify manufacturing costs into different categories and compute the unit cost.

(LO 2), AP

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making

- Splish Brothers Company has been a retailer of audio systems for the past 3 years. However, after a thorough survey of audio system markets Spish Brothers decided to turn its retail store into an audio equipment factory Production began October 1.2025. Direct materials costs for an audio system total $75 per unit Workers on the production lines are paid $15 per hour An audio system takes 7 labor hours to complets. In addition, the rent on the equipment used to assemble audio systems amounts to $5,960 per month Indirect materials cost $7 per system. A supervisor was hired to oversee production her monthly salary is $2.060 Factory janitorial costs are $2.310 monthly Advertising costs for the audio system will be $9.330 per month. The factory building depreciation is $7,080 per year. Property taxes on the factory building will be $8.400 per year (a) Assuming that Splish Brothers manufactures, on average 1.500 audio systems per month enter each cost item on your answer sheet placing the…arrow_forwardRoberts Company manufactures home cleaning products. One of the products, Quickclean, requires 2 pounds of Material A and 5 pounds of Material B per unit manufactured. Material A can be purchased from the supplier for $0.30 per pound and Material B can be purchased for $0.50 per pound. The finished goods inventory on hand at the end of each month must be equal to 4,000 units plus 25% of the next month's sales. The raw materials inventory on hand at the end of each month (for either Material A or Material B) must be equal to 80% of the following month's production needs. Assume that the production budget calls for 26,000 units of Quickclean to be manufactured in June and 32,000 units of Quickclean to be manufactured in July. On May 31 there will be 41,600 pounds of Material A in inventory. The number of pounds of Material A needed for production during June would be: 61,600 51,200 35,600 52,000arrow_forward6. Ibri Company, a manufacturer of stereo systems, started its production in January 2018. For the preceding 3 years had been a retailer of stereo systems. After a thorough survey of stereo system markets, Ibri Company decided to turn its retail store into a stereo equipment factory. Raw materials cost for a stereo system will total $77 per unit. Workers on the production lines are on average paid $11 per hour. A stereo system usually takes 4 hours to complete. In addition, the rent on the equipment used to assemble stereo systems amounts to $5,200 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000. Factory janitorial costs are $1,000 monthly. Advertising costs for the stereo system will be $5,000 per month. The factory building depreciation expense is $8,400 per year. Property taxes on the factory building will be $12,000 per year.arrow_forward

- Roberts Company manufactures home cleaning products. One of the products, Quickclean, requires 2 pounds of Material A and 5 pounds of Material B per unit manufactured. Material A can be purchased from the supplier for $0.30 per pound and Material B can be purchased for $0.50 per pound. The finished goods inventory on hand at the end of each month must be equal to 4,000 units plus 25% of the next month's sales. The raw materials inventory on hand at the end of each month (for either Material A or Material B) must be equal to 80% of the following month's production needs. Assume that on January 1 the inventory of Quickclean was 8,000 units. Expected sales in January are 14,000 units and expected sales in February are 18,000 units. The number of units needed to be manufactured in January would be 14,500. Assume that the production budget calls for 26,000 units of Quickclean to be manufactured in June and 32,000 units of Quickclean to be manufactured in July. On May 31 there will be…arrow_forwardRoberts Company manufactures home cleaning products. One of the products, Quickclean, requires 2 pounds of Material A and 5 pounds of Material B per unit manufactured. Material A can be purchased from the supplier for $0.30 per pound and Material B can be purchased for $0.50 per pound. The finished goods inventory on hand at the end of each month must be equal to 4,000 units plus 25% of the next month's sales. The raw materials inventory on hand at the end of each month (for either Material A or Material B) must be equal to 80% of the following month's production needs. Assume that on January 1 the inventory of Quickclean was 8,000 units. Expected sales in January are 14,000 units and expected sales in February are 18,000 units. The number of units needed to be manufactured in January would be: A. 10,500 B. 14,000 C. 14,500 D. 15,000arrow_forward6. Ibri Company, a manufacturer of stereo systems, started its production in January 2018. For the preceding 3 years had been a retailer of stereo systems. After a thorough survey of stereo system markets, Ibri Company decided to turn its retail store into a stereo equipment factory. Raw materials cost for a stereo system will total $77 per unit. Workers on the production lines are on average paid $11 per hour. A stereo system usually takes 4 hours to complete. In addition, the rent on the equipment used to assemble stereo systems amounts to $5,200 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000. Factory janitorial costs are $1,000 monthly. Advertising costs for the stereo system will be $5,000 per month. The factory building depreciation expense is $8,400 per year. Property taxes on the factory building will be $12,000 per year. Instructions (a) Prepare an answer sheet with the following column headings. Cost…arrow_forward

- Roberts Company manufactures home cleaning products. One of the products, Quickclean, requires 2 pounds of Material A and 5 pounds of Material B per unit manufactured. Material A can be purchased from the supplier for $0.30 per pound and Material B can be purchased or $0.50 per pound. The finished goods inventory on hand at the end of each month must be equal to 4,000 units plus 25% of the next month's sales. The raw materials inventory on hand at the end of each month (for either Material A or Material B) must be equal to 80% of the following month's production needs. Assume that on January 1 the inventory of Quickclean was 8,000 units. Expected sales in January are 14,000 units and expected sales in February are 18,000 units Required: The number of units needed to be manufactured in January would be:-arrow_forwardIrene Corporation manufactures three lines of decorative cabinets for stereo and television sets. Skill is required of the workers and it is not easy to hire persons qualified for the work. At the present time, there are 15 qualified employees (all regular workers) available for this type of work and new personnel are to be hired and trained for the busy first six months of 2021. Each employee works approximately 150 hours a month and is paid the rate of P100 per hour. Production plans based on anticipated sales demand, are given next page in units for each of the three lines of cabinets.arrow_forwardMuspest Supplies is currently evaluating the cost of manufacturing some of the components utilised in their products. Currently the company expects to need 6 000 parts each month. A supplier of the part has been identified and the total cost of purchasing the parts on a monthly basis would be $97 000. In analysing the part costs, the direct labour and materials cost would be $64 000 and the variable overheads would be $22 000.Based only on the relevant cost per unit, which would be the preferred option of Muspest Supplies?HD EDUCATIONA. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case, the best option would be to commence purchasing the part.B. Unit costs to produce the part would be $10.67 with the unit cost to purchase of $ 16.17. In this case, the best option would be to continue to make the part.C. None of the other answers D. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case,…arrow_forward

- Edmund Supplies Company sold 3,170 metal connectors on account to Door Incorporated for $200 each on September 15. Each metal connector costs Edmund $150 to make. Door has 60 days to return the unused goods. Edmund believes that Door will ultimately return 75 of the connectors. On September 29, Door returns 50 connectors. Edmund has a September 30 fiscal year end. At year end, Edmund believes 75 connectors is a good estimate of the total that will be returned. The cost of recovering these products is immaterial. Edmund expects to be able to resell these goods for a profit. Instructions Prepare the following journal entries on the books of Edmund Company: Entries to record the initial sales on September 15. Entries to record the return of goods September 29. Entries to record the year-end adjustment based on estimated returns on September 30.arrow_forward(b) McPro Company, a manufacturer of tennis racket, started production in January 2015. For the proceeding 5 years McPro had been a retailer of sports equipment. After a thorough survey of tennis racket markets, McPro decided to turns its retail store into a tennis racket factory. Raw materials cost for a tennis racket will total RM40 per racket. Workers on the production lines are paid on average RM15 per hour. A racket usually takes 2 hours to complete. In addition, the rent on the factory equipment used to produce rackets amounts to RM1,000 per month. Indirect materials cost RM3 per racket. A supervisor was hired to oversee production; her monthly salary is RM3,500. Factory janitorial cost are RM1200 monthly. Advertising costs for the rackets will be RM6000 per month. The factory building depreciation expense is RM8,400 per year. Property taxes on the factory building will be RM 4,320 per year. Required : Categorize (CLO3,C4) the above cost item according to the following column…arrow_forwardThe F Inc.’s materials manager is considering the installation of a just-in-time (JIT) inventory system for L-20, one of the chemicals used in the production process. Currently, the chemical is purchased for $30 each pound. The firm uses 4,800 pounds L-20 per year. The controller estimates that it costs $150 to place and receive a typical order of L-20. The annual cost of storing L-20 is $1 per pound. F Inc.’s manufacturing engineering team identifies the following effects of adopting a JIT inventory system: 1) F Inc. will order 100 pounds L-20 each time. 2) The cost of placing an order for L-20 will be reduced to $20. 3) Suppliers would add $4 to the price per pound for frequent deliveries. 4) Currently there is a defect-assessment cost of $120,000 per year. This cost is expected a reduction of 20% under the JIT system. F Inc. requires a 10% annual rate of return on investment Required: From a financial perspective, determine whether it is in the best interest of F to…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning