Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 13, Problem 25P

LO.2 Oak Corporation has the following general business credit carryovers.

If the general business credit generated by activities during 2019 equals $36,000 and the total credit allowed during the current year is $60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Oak Corporation has the following general business credit carryovers:

2016

$7,250

2017

21,750

2018

8,250

2019

25,750

Total carryovers

$63,000

The general business credit generated by activities during 2020 equals $50,400 and the total credit allowed during the current year is $87,000 (based on tax liability).

a. Enter the amount (if any) of each year's carryover utilized in 2020.

Year

Amount ofCarryoverUtilized

2016

$

2017

$

2018

$

2019

$

2020

$

b. What is the amount of any unused credits carried forward to 2021?

16. Umasa Company reported rental revenue of P2,210,000 in the cash basis income tax return for the year ended November 30, 2020. Rent receivable – Nov. 30, 2020 is P1,060,000; Rent receivable – Nov. 30, 2019 is P800,000; and Uncollectible rent written off during the fiscal year is P30,000. Under accrual basis, what amount should be reported as rent revenue?

a. P1,920,000

b. P2,240,000

c. P2,500,000

d. P1,980,000

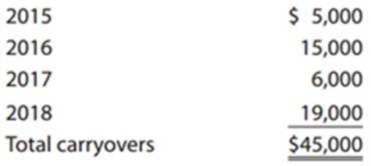

Oak Corporation holds the following general business credit carryovers:

2016

$5,000

2017

15,000

2018

6,000

2019

19,000

Total carryovers

$45,000

The Oak's general business credit generated by 2020 activities equals $36,000 and the total credit allowed during the current year is

$60,000 (based on tax liability).

a. Enter the amount (if any) of each year's carryover utilized in 2020.

Amount of

Carryover

Year

Utilized

2016

2017

2018

2019

2020

b.

What is the amount of any unused credits carried forward to 2021?

%24

Chapter 13 Solutions

Individual Income Taxes

Ch. 13 - Prob. 1DQCh. 13 - LO.2 Clint, a sell-employed engineering...Ch. 13 - Prob. 3DQCh. 13 - Prob. 4DQCh. 13 - Prob. 5DQCh. 13 - LO.4 Mark and Lisa are approaching an exciting...Ch. 13 - Prob. 7DQCh. 13 - Prob. 8DQCh. 13 - Prob. 9DQCh. 13 - Describe the two additional Medicare taxes that...

Ch. 13 - Prob. 11CECh. 13 - Prob. 12CECh. 13 - LO.3 During 2019, Lincoln Company hires seven...Ch. 13 - Prob. 14CECh. 13 - Samuel and Annamaria are married, file a joint...Ch. 13 - Prob. 16CECh. 13 - Prob. 17CECh. 13 - LO.4, 8 Ava and her husband, Leo, file a joint...Ch. 13 - Prob. 19CECh. 13 - Prob. 20CECh. 13 - LO.5 In 2019, Bianca earned a salary of 164,000...Ch. 13 - Prob. 22CECh. 13 - LO.7 Determine the additional Medicare taxes for...Ch. 13 - Prob. 24PCh. 13 - LO.2 Oak Corporation has the following general...Ch. 13 - Prob. 26PCh. 13 - Prob. 27PCh. 13 - Prob. 28PCh. 13 - Prob. 29PCh. 13 - Prob. 30PCh. 13 - LO.4 Jason, a single parent, lives in an apartment...Ch. 13 - LO.4, 8 Joyce, a widow, lives in an apartment with...Ch. 13 - Prob. 33PCh. 13 - Prob. 34PCh. 13 - Prob. 35PCh. 13 - Prob. 36PCh. 13 - Prob. 37PCh. 13 - Prob. 38PCh. 13 - LO.5 During 2019, Greg Cruz (1401 Orangedale Road,...Ch. 13 - Prob. 40PCh. 13 - Jane, who is expecting to finish college in May...Ch. 13 - Julie, being self-employed, is required to make...Ch. 13 - Prob. 43PCh. 13 - Beth R. Jordan lives at 2322 Skyview Road, Mesa,...Ch. 13 - Prob. 45CPCh. 13 - Ashby and Curtis, married professionals, have a...Ch. 13 - Prob. 2RPCh. 13 - Prob. 4RPCh. 13 - Prob. 1CPACh. 13 - Prob. 2CPACh. 13 - Prob. 3CPACh. 13 - Prob. 4CPACh. 13 - Prob. 5CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)arrow_forward1. What amount should Tokwa't Baboy Company report in its 2020 income statement as total provision for income tax? Assume a 30% tax rate.arrow_forwardRequired: 1. Determine the amounts necessary to record Allmond's income taxes for 20: Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $25 million and taxable income of $33 million 2. What is Allmond's 2021 net income? for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between accounting income and taxable income is estimated product warranty costs. Assume that expected payments and scheduled tax rates (based on recently enacted tax legislation) are as follows: Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 GJ Required 2 Prepare the appropriate journal entry. (If no entry is required for a transaction/e account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5 View transaction list 1 Record 2021 income taxes. X Cr 2022 2023 2024 2025 $2 million 2 million 1 million 3 million 35% 35% 35% 25% Required: 1. Determine the amounts necessary to…arrow_forward

- 1. soru At the end of 2019, The Business with 20% Corporate tax rate has Expenses: TL3.150.000 and Revenues: TL3.375.000. How much is the Tax Payable if the business prepaid income tax of TL15.000 during the accounting period? a.TL30.000 b.TL15.000 c.TL45.000 d.TL60.000arrow_forwardDelta has interest receivable which has a carrying amount of $75,000 in its statement of financial position at 31 December 2020. The related interest revenue will be taxed on a cash basis in 2021. Delta has trade receivables that have a carrying amount of $105,000 in its statement of financial position at 31 December 2020. The related revenue has been included in its statement of profit or loss for the year to 31 December 2020. Required: According to HKAS 12 ‘Income Taxes’, what is the total tax base of interest receivable and trade receivables for Delta at 31 December 2020? A. $105,000 B. $75,000 C. Nil D. $180,000arrow_forward1. In 2021, Eric Corporation reported P90,000 net income before income taxes. The income tax rate for 2021 was 30 percent. Eric had an unused P60,000 net operating loss carryforward arising in 2020 when the tax rate was 35 percent. The income tax expense Eric would report for 2021 would bearrow_forward

- Given the following information, how much is the total income tax credit available for deduction from the regular corporate income tax due? Quarterly income tax payments P320,000.00 Creditable withholding taxes withheld by customers P 80,000.00 Net operating loss carry-over from 2021 P150,000.00 MCIT excess credits from 2020 P 50,000.00 Group of answer choices P50,000.00 P600,000.00 P450,000.00 P400,000.00arrow_forwardLe Bron Corporation has the following information for 2021 taxable year: Quarter RCIT MCIT CWT First P200,000 P160,000 P40,000 Second 240,000 500,000 60,000 Third 500,000 150,000 80,000 Fourth 300,000 200,000 70,000 Additional information: Excess MCIT from 2020: P60,000 Excess tax credits from 2020: P20,000 1.) How much was the income tax payable for the first quarter? a. 200,000 b. 160,000 c. 120,000 d. 80,000 2.) How much was the income tax payable for the second quarter? a. 660,000 b. 460,000 c. 200,000 d. 160,000 3.) How much was the annual income tax payable? a. 1,260,000 b. 390,000 c. 230,000 d. 930,000arrow_forwardJKL Corp reports net income on its 2019 financial statements before income tax expense of P400,000. JKL has been profitable in the past and expects to continue to be profitable. The company expensed warranty cost in 2016 for P35,000 that is expected to impact tax return in 2020. JKL also had P60,000 in revenue that will not be taxed until 2021. JKL has a tax rate for 2019 of 30% and enacted rate of 40% beyond 2019. In addition JKL made four estimated tax payments of P25,000 each in 2019. 1. How much will JKLCorp report as taxable income on its income statement for December 31, 2019? 2. How much would JKL Corp report as current year income tax expense on the December 31, 2019 income statement? 3. How much would JKL Corp report as deferred income tax expense on December 31, 2019 income statement? 7,500arrow_forward

- A corporation which started in 2016 reported the following date in 2020: Total gross income 3,000,000 Regular allowable deductions 1,600,000 Special allowance deductions 400,000 How much is the income tax due?arrow_forwardHow much is the excessive tax benefits to be credited to tax expense on January 2, 2019 according to the ASU 2016-09? Answer is $90 million. Please explain the reasoning and calculationsarrow_forwardConsider the following data for 2019 from an after tax cash flow analysis.What is the after tax cash flow for 2019? Before-Tax-and-Loan = $23,000Loan Principal Payment = $3,203 Loan Interest Payment = $3,878. Depreciation Deduction = $12,490 Taxable Income = $6,633 Taxes Due = $1,658. a. $20,744 b. $14,262 c. $3,430 d. $1,175.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License