1.

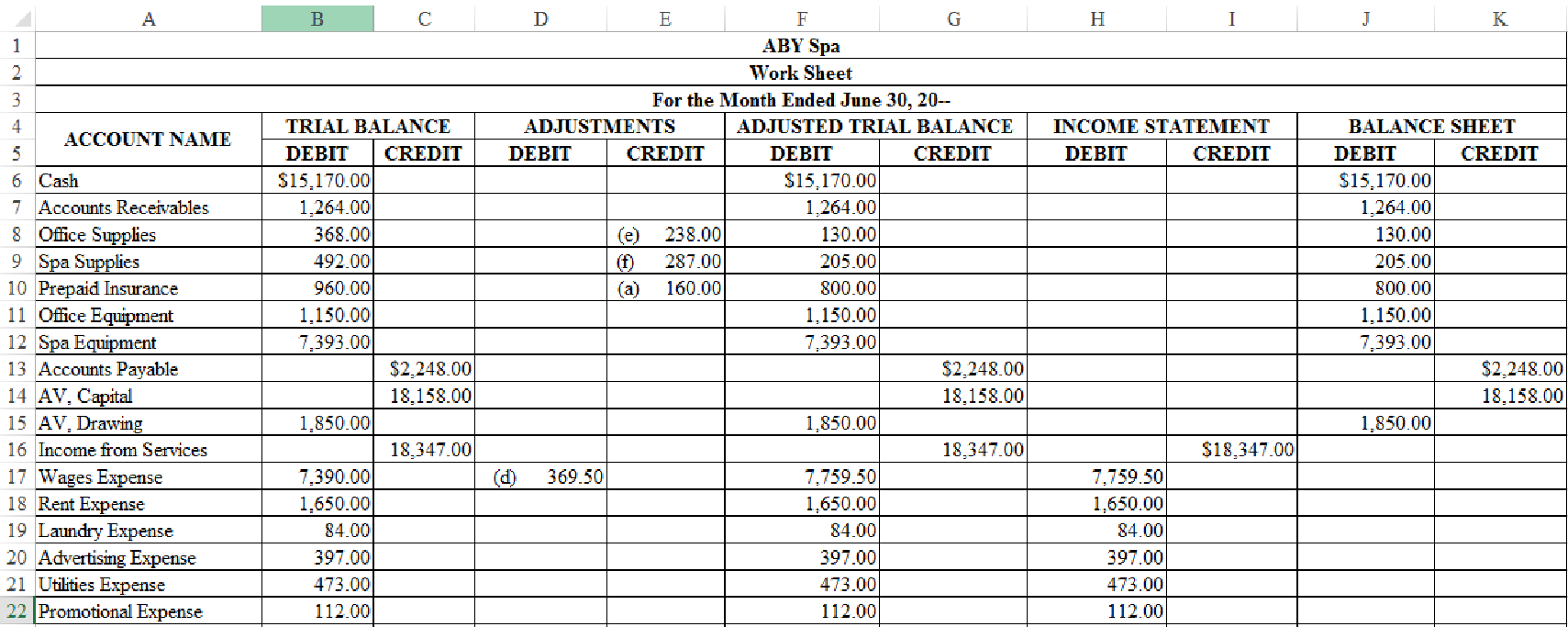

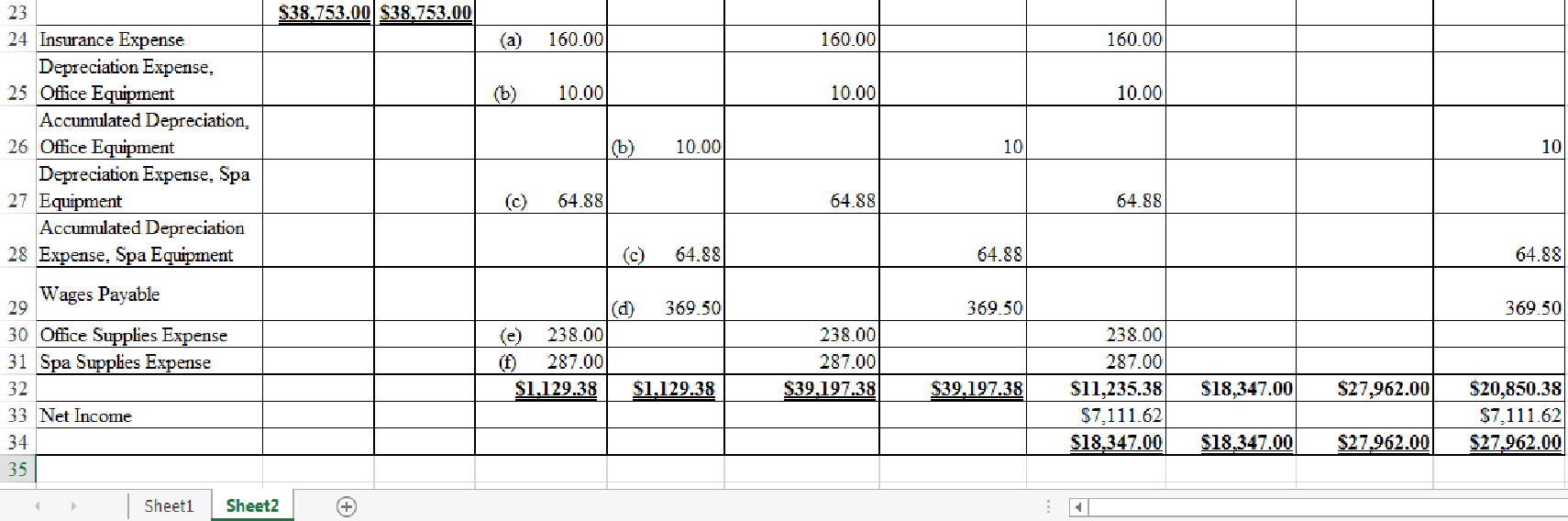

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended June 30, 20--.

1.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended June 30, 20--.

Figure-(1)

2.

Prepare adjusting journal entries for ABY Spa for the month ended June 30, 20--.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for ABY Spa for the month ended June 30, 20--.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Insurance Expense | 618 | 160 | ||

| Prepaid Insurance | 117 | 160 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (1)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Working Note 1:

Calculate the value of insurance expense for 1 month.

Adjusting entry (b) for the

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Depreciation Expense, Office Equipment | 619 | 10.00 | ||

| 125 | 10.00 | |||||

| (Record depreciation expense) | ||||||

Table (2)

Description:

- Depreciation Expense, Office Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Office Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 2:

Compute monthly depreciation expense for the office equipment.

Adjusting entry (c) for the depreciation expense for spa equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Depreciation Expense, Spa Equipment | 620 | 64.88 | ||

| Accumulated Depreciation, Spa Equipment | 129 | 64.88 | ||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Spa Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Spa Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 3:

Compute monthly depreciation expense for the spa equipment.

Adjusting entry (d) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Wages Expense | 611 | 369.50 | ||

| Wages Payable | 212 | 369.50 | ||||

| (Record accrued wages expenses) | ||||||

Table (4)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Working Note 4:

Calculate the value of wages expense for 1 day.

Adjusting entry (e) for the office supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Office Supplies Expense | 613 | 238 | ||

| Office Supplies | 114 | 238 | ||||

| (Record part of supplies consumed) | ||||||

Table (5)

Description:

- Office Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Office Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 5:

Calculate the value of office supplies expense for the month.

Adjusting entry (f) for the spa supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Spa Supplies Expense | 614 | 287 | ||

| Spa Supplies | 115 | 287 | ||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Spa Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Spa Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 6:

Calculate the value of spa supplies expense for the month.

3.

3.

Explanation of Solution

Post the adjusting entries journalized in Part (2) in the ledger accounts of general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 15,000.00 | 15,000.00 | |||

| 3 | 1 | 960.00 | 14,040.00 | ||||

| 3 | 1 | 2,000.00 | 12,040.00 | ||||

| 3 | 1 | 1,650.00 | 10,390.00 | ||||

| 5 | 1 | 248.00 | 10,142.00 | ||||

| 5 | 1 | 112.00 | 10,030.00 | ||||

| 7 | 1 | 1,847.50 | 8,182.50 | ||||

| 7 | 1 | 2,630.00 | 10,812.50 | ||||

| 11 | 1 | 873.00 | 9,939.50 | ||||

| 14 | 1 | 3,703.00 | 13,642.50 | ||||

| 14 | 1 | 1,847.50 | 11,795.00 | ||||

| 18 | 1 | 1,200.00 | 10,595.00 | ||||

| 21 | 1 | 4,758.00 | 15,353.00 | ||||

| 21 | 1 | 1,847.50 | 13,505.50 | ||||

| 25 | 1 | 73.00 | 13,432.50 | ||||

| 28 | 1 | 1,847.50 | 11,585.00 | ||||

| 28 | 1 | 84.00 | 11,501.00 | ||||

| 30 | 1 | 5,992.00 | 17,493.00 | ||||

| 30 | 1 | 1,850.00 | 15,643.00 | ||||

| 30 | 1 | 225.00 | 15,418.00 | ||||

| 30 | 1 | 248.00 | 15,170.00 | ||||

Table (7)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 325.00 | 325.00 | |||

| 14 | 1 | 486.00 | 811.00 | ||||

| 21 | 1 | 344.00 | 1,155.00 | ||||

| 30 | 1 | 109.00 | 1,264.00 | ||||

Table (8)

| ACCOUNT Office Supplies ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 248 | 248 | |||

| 5 | 1 | 120 | 368 | ||||

| 30 | Adjusting | 4 | 238 | 130 | |||

Table (9)

| ACCOUNT Spa Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 492 | 492 | |||

| 30 | Adjusting | 4 | 287 | 205 | |||

Table (10)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 960 | 960 | |||

| 30 | Adjusting | 4 | 160 | 800 | |||

Table (11)

| ACCOUNT Office Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 318 | 318 | |||

| 5 | 1 | 832 | 1,150 | ||||

Table (12)

| ACCOUNT Accumulated Depreciation, Office Equipment ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 10.00 | 10.00 | ||

Table (13)

| ACCOUNT Spa Equipment ACCOUNT NO. 128 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 3,158 | 3,158 | |||

| 3 | 1 | 4,235 | 7,393 | ||||

Table (14)

| ACCOUNT Accumulated Depreciation, Spa Equipment ACCOUNT NO. 129 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 64.88 | 64.88 | ||

Table (15)

| ACCOUNT Accounts Payable ACCOUNT NO. 211 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 2,235 | 2,235 | |||

| 3 | 1 | 492 | 2,727 | ||||

| 5 | 1 | 318 | 3,045 | ||||

| 5 | 1 | 397 | 3,442 | ||||

| 5 | 1 | 832 | 4,274 | ||||

| 5 | 1 | 120 | 4,394 | ||||

| 11 | 1 | 873 | 3,521 | ||||

| 18 | 1 | 1,200 | 2,321 | ||||

| 25 | 1 | 73 | 2,248 | ||||

Table (16)

| ACCOUNT Wages Payable ACCOUNT NO. 212 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 369.50 | 369.50 | ||

Table (17)

| ACCOUNT AV, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 15,000 | 15,000 | |||

| 1 | 1 | 3,158 | 18,158 | ||||

Table (18)

| ACCOUNT AV, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 1 | 1,850 | 1,850 | |||

Table (19)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 2,630 | 2,630 | |||

| 7 | 1 | 325 | 2,955 | ||||

| 14 | 1 | 3,703 | 6,658 | ||||

| 14 | 1 | 486 | 7,144 | ||||

| 21 | 1 | 4,758 | 11,902 | ||||

| 21 | 1 | 344 | 12,246 | ||||

| 30 | 1 | 5,992 | 18,238 | ||||

| 30 | 1 | 109 | 18,347 | ||||

Table (20)

| ACCOUNT Wages Expense ACCOUNT NO. 611 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 1,847.50 | 1,847.50 | |||

| 14 | 1 | 1,847.50 | 3,695.00 | ||||

| 21 | 1 | 1,847.50 | 5,542.50 | ||||

| 28 | 1 | 1,847.50 | 7,390.00 | ||||

| 30 | Adjusting | 4 | 369.50 | 7,759.50 | |||

Table (21)

| ACCOUNT Rent Expense ACCOUNT NO. 612 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 1,650 | 1,650 | |||

Table (22)

| ACCOUNT Office Supplies Expense ACCOUNT NO. 613 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 238 | 238 | ||

Table (23)

| ACCOUNT Spa Supplies Expense ACCOUNT NO. 614 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 287 | 287 | ||

Table (24)

| ACCOUNT Laundry Expense ACCOUNT NO. 615 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 28 | 1 | 84 | 84 | |||

Table (25)

| ACCOUNT Advertising Expense ACCOUNT NO. 616 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 397 | 397 | |||

Table (26)

| ACCOUNT Utilities Expense ACCOUNT NO. 617 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 1 | 225 | 225 | |||

| 30 | 1 | 248 | 473 | ||||

Table (27)

| ACCOUNT Insurance Expense ACCOUNT NO. 618 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 160 | 160 | ||

Table (28)

| ACCOUNT Depreciation Expense, Office Equipment ACCOUNT NO. 619 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 10 | 10 | ||

Table (29)

| ACCOUNT Depreciation Expense, Spa Equipment ACCOUNT NO. 620 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 64.88 | 64.88 | ||

Table (30)

| ACCOUNT Promotional Expense ACCOUNT NO. 630 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 112 | 112 | |||

Table (31)

4.

Prepare an adjusted trial balance for ABY Spa as at June 30, 20--, based on the account balances derived in Part (3).

4.

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for ABY Spa as at June 30, 20--, based on the account balances derived in Part (3).

| ABY Spa | ||

| Adjusted Trial Balance | ||

| June 30, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $15,170.00 | |

| Accounts Receivable | 1,264.00 | |

| Office Supplies | 130.00 | |

| Spa Supplies | 205.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | 1,150.00 | |

| Accumulated Depreciation, Office Equipment | $10.00 | |

| Spa Equipment | 7,393.00 | |

| Accumulated Depreciation, Spa Equipment | 64.88 | |

| Accounts Payable | 2,248.00 | |

| Wages Payable | 369.50 | |

| AV, Capital | 18,158.00 | |

| AV, Drawing | 1,850.00 | |

| Income from Services | 18,347.00 | |

| Wages Expense | 7,759.50 | |

| Rent Expense | 1,650.00 | |

| Office Supplies Expense | 238.00 | |

| Laundry Expense | 84.00 | |

| Advertising Expense | 397.00 | |

| Utilities Expense | 473.00 | |

| Promotional Expense | 112.00 | |

| Depreciation Expense, Office Equipment | 10.00 | |

| Depreciation Expense, Spa Equipment | 64.88 | |

| Spa Supplies Expense | 287.00 | |

| Insurance Expense | 160.00 | |

| Total | $39,197.38 | $39,197.38 |

Table (32)

Hence, the debit and credit total of adjusted trial balance of ABY Spa at June 30, 20-- is $39,197.38.

5.

Prepare an income statement of ABY Spa for the month ended June 30, 20--, based on the account balances derived in Part (3).

5.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of ABY Spa for the month ended June 30, 20--.

| ABY Spa | ||

| Income Statement | ||

| For the Month Ended June 30, 20-- | ||

| Revenues: | ||

| Income from Services | $18,347.00 | |

| Expenses: | ||

| Wages Expense | $7,759.50 | |

| Rent Expense | 1,650.00 | |

| Office Supplies Expense | 238.00 | |

| Laundry Expense | 84.00 | |

| Advertising Expense | 397.00 | |

| Utilities Expense | 473.00 | |

| Promotional Expense | 112.00 | |

| Depreciation Expense, Office Equipment | 10.00 | |

| Depreciation Expense, Spa Equipment | 64.88 | |

| Spa Supplies Expense | 287.00 | |

| Insurance Expense | 160.00 | |

| Total expenses | 11,235.38 | |

| Net income | $7,111.62 | |

Table (33)

6.

Prepare a statement of owners’ equity of ABY Spa, based on the account balances derived in Part (3), and net income computed in Part (5).

6.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for ABY Spa for the month ended June 30, 20--.

| ABY Spa | ||

| Statement of Owners’ Equity | ||

| For the Month Ended June 30, 20-- | ||

| AV, Capital, June 1, 20-- | $0 | |

| Investments during June | $18,158.00 | |

| Net income for June | 7,111.62 | |

| 25,269.62 | ||

| Less: Withdrawals for June | 1,850.00 | |

| Increase in capital | 23,419.62 | |

| AV, Capital, June 30, 20-- | $23,419.62 | |

Table (34)

7.

Prepare a balance sheet for ABY Spa, based on the account balances derived in Part (3), and capital of the owner from the statement of owners’ equity prepared in Part (6).

7.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for ABY Spa as at June 30, 20--.

| ABY Spa | ||

| Balance Sheet | ||

| June 30, 20-- | ||

| Assets | ||

| Cash | $15,170.00 | |

| Accounts Receivable | 1,264.00 | |

| Office Supplies | 130.00 | |

| Spa Supplies | 205.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | $1,150.00 | |

| Less: Accumulated Depreciation, Office Equipment | 10.00 | 1,140.00 |

| Spa Equipment | 7,393.00 | |

| Less: Accumulated Depreciation, Spa Equipment | 64.88 | 7,328.12 |

| Total assets | $26,037.12 | |

| Liabilities | ||

| Accounts Payable | $2,248.00 | |

| Wages Payable | 369.50 | |

| Total Liabilities | $2,617.50 | |

| Owners’ Equity | ||

| AV, Capital | 23,419.62 | |

| Total Liabilities and Owners’ Equity | $26,037.12 | |

Table (35)

Want to see more full solutions like this?

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

- If the Prepaid Insurance account had a balance of $12,000, representing one years policy premium, which was paid on July 1, what entry would be needed to adjust the Prepaid Insurance account at the end of December, before preparing the financial statements?arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forward

- You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance.3.What is the ethical dilemma you face? What are the ethical considerations? Consider your options and responsibilities as assistant controller.4.Identify the key internal and external stakeholders. What are the negative impacts that can happen if you do not follow the instructions of your supervisor?5.What are the…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardReviewing insurance policies revealed that a single policy was purchased on August 1, for one year’s coverage, in the amount of $6,000. There was no previous balance I n the Prepaid Insurance account at that time. Based on the information provided:- Make the December 31 adjusting journal entry to bring the balances to correct. Show the impact that these transactions had.arrow_forward

- Reviewing insurance policies revealed that a single policy was purchased on August 1, for one year’s coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided: A. Make the December 31 adjusting journal entry to bring the balances to correct. If an amount box does not require an entry, leave it blank. B. Show the impact that these transactions had. If an amount box does not require an entry, leave it blank.arrow_forwardFor the following, prepare a correcting entry, showing your work. Your final answer must be ONE journal entry. If a problem asks for impact to the financial statements, you must address Revenue/Expense, Net Income, and Assets/Liabilities. 1. On February 28, your company takes out a 2-year insurance policy that has a $3,000 annual premium. The entire amount is paid when the policy is taken out and is recorded in Prepaid Insurance. In the same year the policy is taken out, you notice the adjusting entry debits Insurance Expense and credits Prepaid Insurance for $1500. What is your correcting entry? If the correcting entry is not made, what is the impact to the financial statements? 2. Your company prepays rent 2 years in advance. On August 1, they prepaid $15,000 for 2 years' rent and recorded the entire amount to Rent Expense. At the end of the year, the AJE DR Prepaid Rent and CR Rent Expense for $8,000. What is the correcting entry? If the correcting entry is not made, what is the…arrow_forwardPrepare adjusting journal entries for the month of December. The insurance policy is for 1 year. List the debit entries before credit entries. If no entry is required, select No Entry.arrow_forward

- I. The senior accountant for Koo Graphics discovered that the company'e accounting clerk had a different method of recording the purchase cf automobile insurance. Specifically, when one-year policies were purchased on July 1, the clerk debited Insurance Expense $7200 and credited Bank $7200, A. Has the clerk done anything seriously wrong? Explain. B. Use the T-accounts in your Workbook to calculate the year-end adjustment for insurance for December 31. Journalize the adjusting entry.arrow_forwardFrom each of the following December 31 adjusting journal entries, prepare the original journal entry that was recorded by supplying the blanks provided. The first one is already done for you. You may print and write the answers or encode the answers immediately. Prepaid Insurance 240 Insurance Expense 240 Supplies Expense 1,200 Supplies 1,200 Rent Revenue 6,300 Unearned Rent Revenues 6,300 Unearned Commissions Revenue 4,200 Commissions Revenue 4,200 Additional Information: Yearly insurance premium is effective and payable every March 1. Supplies are purchased every May 1 and are used evenly throughout the year. Annual rent is received every April 1. Commissions are collected every June 1 and earned evenly throughout the year. Original Journal Entries 1.(example) Debit: Insurance Expense 1,440 Credit:…arrow_forwardThe fiscal year-end for Mason's Landscaping and Snow Removal is December 31. Record the adjusting entries for December 31, 2014. Hint: It is helpful to record the original transactions (or account balances) in your own rough notes as part of your analysis and calculations of year-end adjusting entries. T-accounts can be very useful for doing this. However, the only entries that should be recorded in the journal for this assignment are the December 31 adjusting entries. The accounts in Mason's ledger are: Bank Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Truck Assignment 1 - Adjusting Entries Accounts Payable Unearned Service Fees Bank Loan B. Mason, Capital B. Mason, Drawings Service Fees Earned Rent Expense Insurance Expense Supplies Expense Office Expense Maintenance Expense Truck Expense Interest Expense 1. On July 1, 2014, a customer signed a contract and agreed to pay $840 for 12 months of landscaping and snow removal services. 2. The balance in the Supplies account…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College