Concept explainers

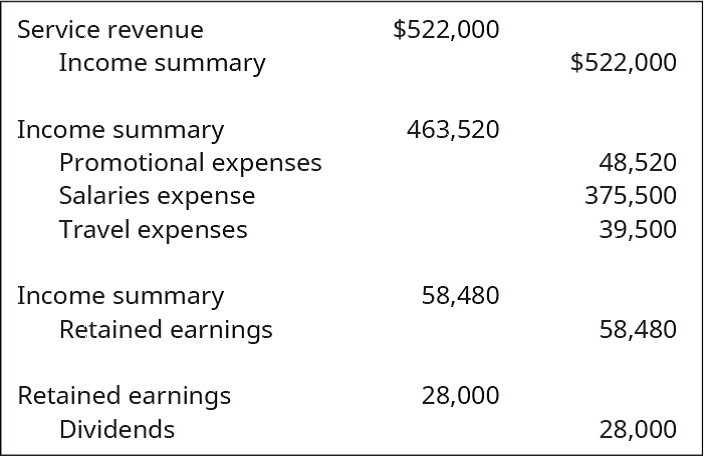

Assume you are a senior accountant and have been assigned the responsibility for making the entries to close the books for the year. You have prepared the following four entries and presented them to your boss, the chief financial officer of the company, along with the company CEO, in the weekly staff meeting:

As the CEO was reviewing your work, he asked the question, “What do these entries mean? Can we learn anything about the company from reviewing them?”

Provide an explanation to give to the CEO about what the entries reveal about the company’s operations this year.

Trending nowThis is a popular solution!

Chapter 5 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Managerial Accounting (4th Edition)

Managerial Accounting (5th Edition)

Horngren's Accounting (11th Edition)

Principles of Accounting Volume 2

Financial Accounting (12th Edition) (What's New in Accounting)

- Assume you are a newly-hired accountant for a local manufacturing firm. You have enjoyed working for the company and are looking forward to your first experience participating in the preparation of the companys financial statements for the year-ending December 31, the end of the companys fiscal year. As you are preparing your assigned journal entries, your supervisor approaches you and asks to speak with you. Your supervisor is concerned because, based on her preliminary estimates, the company will fall just shy of its financial targets for the year. If the estimates are true, this means that all 176 employees of the company will not receive year-end bonuses, which represent a significant portion of their pay. One of the entries that you will prepare involves the upcoming bond interest payment that will be paid on January 15 of the next year. Your supervisor has calculated that, if the journal entry is dated on January 1 of the following year rather than on December 31 of the current year, the company will likely meet its financial goals thereby allowing all employees to receive year-end bonuses. Your supervisor asks you if you will consider dating the journal entry on January 1 instead of December 31 of the current year. Assess the implications of the various stake holders and explain what your answer will be.arrow_forwardYou are the staff accountant working at a local tutoring center. The monthly financial statements (Income Statement, Statement of Retained Earnings, and Balance Sheet) were just finalized and released to the employees of the tutoring center. You hear some of the other employees talking about the financial statements. In most cases, the employees do not understand the purpose of the statements. You have been asked by your supervisor to create a MEMO to be sent to the employees of the tutoring center that includes the following: Select either the Balance Sheet OR the Income Statement and explain the purpose of the statement and why it is important (i.e. what should the reader know about the company by looking at the statement).arrow_forwardYou are the staff accountant working at a local tutoring center. The monthly financial statements (Income Statement, Statement of Retained Earnings, and Balance Sheet) were just finalized and released to the employees of the tutoring center. You hear some of the other employees talking about the financial statements. In most cases, the employees do not understand the purpose of the statements. You have been asked by your supervisor to create a MEMO to be sent to the employees of the tutoring center that includes the following: Reflect on how you think you and your peers at the tutoring center may be able to apply this knowledge/understanding of accounting in your future (in your career, in your personal life, in any aspect of your life).arrow_forward

- Your company has semi-annual training sessions for all new employees. These training sessions provide information to all new employees about the organization and the role of each department within the organization. As an experienced management accountant, also known as a cost accountant, you have been assigned to develop a 30-minute presentation that explains what managerial accounting is and how it is used by others within the company. Prompt: Identify two concepts that you believe should be included in the presentation. You should provide a brief explanation of both concepts.arrow_forwardYou are the staff accountant working at a local tutoring center. The monthly financial statements (Income Statement, Statement of Retained Earnings, and Balance Sheet) were just finalized and released to the employees of the tutoring center. You hear some of the other employees talking about the financial statements. In most cases, the employees do not understand the purpose of the statements. You have been asked by your supervisor to create a MEMO to be sent to the employees of the tutoring center that includes the following: Identify and explain (in words everyone can understand) each item in the accounting equation; what does each item represents and where does each item appear on the financial statements. Providing examples would be beneficial!arrow_forwardYou are the staff accountant working at a local tutoring center. The monthly financial statements (Income Statement, Statement of Retained Earnings, and Balance Sheet) were just finalized and released to the employees of the tutoring center. You hear some of the other employees talking about the financial statements. In most cases, the employees do not understand the purpose of the statements. You have been asked by your supervisor to create a MEMO to be sent to the employees of the tutoring center that includes the following: Explain how accounting became a “norm” (what made a system of accounting necessary) and reflect on why YOU think it is beneficial for society as a whole to have a standard method of accounting.arrow_forward

- Prior to Tuesday midnight of Week 5, post at least once about this week's Wiley assignment. You are highly encourage to ask your fellow learners for help or share your own insight as you work through the assignment. Try to add constructive points to the discussion rather than, for instance, simple comments about the difficulty of the assignment. Some guiding points: What were some interesting management accounting concepts that came up this week? At this point, do you see the management accounting approach being more or less useful than financial accounting for you? Why?arrow_forwardThe CEO has asked you to kick off his monthly meeting with an ethics current event and 3 activities or questions (or a combination) to start a discussion for a positive dialogue with the employees of your company as 2 managers were recently fired for accounting ethical issues. Your CEO is depending on you to help him out as you may be in line for the next CFO of the company. Your assignment will be to look up an accounting current event regarding accounting ethical dilemmas (current event must be within 2 years) and initiate 3 activities or questions (or a combination) to prevent any ethical issues in the future. Answer the following questions and upload them to Moodle. 1. URL of Current Event 2. Title of Current Event 3. Author and Date 4. Please write a quick synopsis of the current eventarrow_forwardThe New Job Outline of the case You are a professionally qualified accountant, recently retired from your position as the financial director of Company A, which is a listed company. Company A operates in the heavy engineering industry and you worked there for over 12 years. Prior to this, you had spent 10 years as an audit partner in a large accountancy firm. You receive a phone call from a head-hunter with an executive recruitment agency, acting on behalf of a company’s nominations committee. After the usual small talk, he cuts to the chase: “You have been recommended to me as a suitable candidate for a very prominent non-executive role that is available at the moment. The company, Company B, is a listed company, seeking a non-executive director who will also serve as the chair of the company’s audit committee.” He adds that Company B is a well-known financial services company. You are not struggling financially. You have a reasonable pension, but the extra cash from this role…arrow_forward

- Suppose you are a part of a group of students from a prominent university and were sent out as a team to work with a leading merchandizing company as a part of a work experience program. The team having been introduced to the general manger was told that the Accountant who normally prepares the financial statements has suddenly resigned and there is no one available to prepare the company’s financial statements which are now due. As aspiring university students, you have expressed an interest in taking on the task. You are required to analyse the problem at hand then apply the accrual basis of accounting in the preparation of the company’s financial statements.arrow_forwardAfter completing your first degree in accounting you have been employed by XYZ Company as an account officer. The Management of the company has tasked you to implement a computerized accounting system.RequiredIn a paragraph each, address the following questions:a) Discuss five benefits associated with the implementation of the computerizedaccounting system within the company.b) Giventhattherearesomanyaccountingpackagesonthemarket,whatshouldyoube looking for when selecting a computerized accounting package for the company?Explain any five factors to considerc) Assuming you procure a Sales Ledger package, what kind of reports should weexpect? List five types of reports expected to be generated.d) Explainthedifferencebetweenastand-alonepackageandanintegratedpackage?Explain two advantaged and two disadvantages of an integrated packagee) Before a new accounting package can be deployed, it needs to be configured. What does it mean to configure an accounting package? Explain the processes…arrow_forwardAssume that you are currently working as an accountant, and your manager has to take an unexpected sick leave. Because you did very well in your accounting classes, the Senior Accountant asks you to step up and help with the review of reconciliations. What would be your first step? Maybe you would dive right into it, assuming you would figure out what to do as you moved through all the existing reconciliations, or maybe you would ask for a copy of policies and procedures for this task if any exist, so you could find instructions without asking the Senior Accountant constantly what to do. In addition to reviewing reconciliations, you will need to review disclosures to financial statements. How would you know if all the necessary disclosures were prepared and contained correct information?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L